NadexGO is the progressive web app for trading on the move. You can trade anywhere, from any mobile device, giving you more flexibility to navigate the markets your way. If you have a smartphone or tablet, you can trade.

What is NadexGO?

NadexGO is a progressive web app. It won’t use up your phone’s memory, and any updates will happen automatically, so each time you open the app, you’ll be using the latest version.

NadexGO is compatible with all iOS and Android mobile and tablet devices.

How to use NadexGO

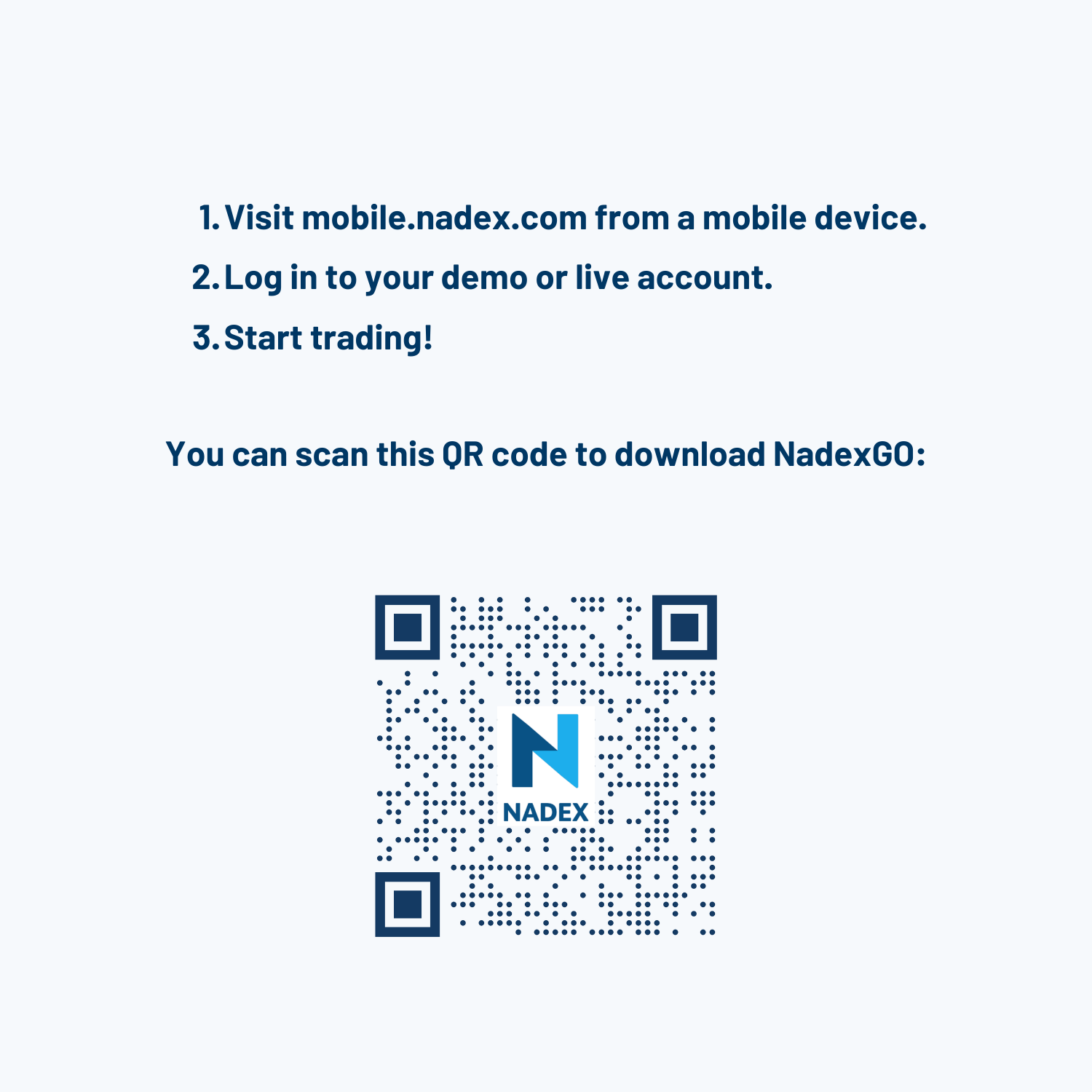

Here's how to get started with NadexGO:

If you don't have an account yet, sign up for one first.

Add NadexGO to your home screen for easy access

You can add NadexGO to your home screen so you can launch it in one click, just as you would with any other app.

The platform can keep you logged in based on your preferences for quick and easy access to the markets.

An advanced mobile trading experience: an ideal platform for day traders

We recently upgraded our trading platform to bring you a more streamlined experience – perfect for day traders needing easy, continuous access to the markets and trades in progress. The platform layout has been enhanced, as have the charts and general functionality. If you haven’t yet experienced the new Nadex platform, go and take a look – it was designed by traders, for traders, to bring you an enhanced, intuitive experience.

You’ll have access to a full range of features as you would when trading on a desktop computer, but with an optimized view for trading on a smaller screen. This includes:

Easy-to-use order tickets, clearly showing your potential profit or loss before you trade.

Powerful, customizable charts complete with technical indicators such as:

Bollinger Bands®

Moving averages

Relative strength index

Ichimoku

Stochastics

A range of drawing tools allow you to mark up charts, and you can save your chart preferences.

A window to easily manage your orders, open positions, and to view your account history. From here, you can monitor your trades and close out early if preferred.

Full account management, including simple funding and withdrawal options. You can easily deposit and withdraw funds from your Nadex account – using a debit card is the simplest method of doing so, from wherever you might be trading in the world. Learn more about funding your account.

What markets can you trade on the Nadex app?

You can trade the same range of markets on the Nadex app as you can when using the desktop platform. Just navigate to them using the four options along the bottom of your screen: home, markets, monitor, and account.

From here, you can access the following markets:

Stock indices: you can speculate on a range of global indices markets including the US 500 and FTSE 100.

Forex: find opportunities on major pairs and emerging currencies including EUR/USD, EUR/GBP, USD/JPY, and USD/MXN.

Commodities: access commodity markets including crude oil, natural gas, gold, and silver.

Events: predict the strength of the US economy. Trade binary options based on upcoming economic events, such as weekly jobless claims and nonfarm payroll releases.

Access these markets with Nadex Binary Options, Knock-Outs, and Call Spreads: limited risk contracts that are a notable fit for day traders.

Start day trading with the Nadex app

Open a live account for free - that's right, no minimum deposit required. Sign up for a Nadex account or explore our platform first with a free demo account.

Learn more about our products, markets, and platform:

Get started with technical analysis

Create your trading plan

Manage your trading risk successfully

Learn to improve your trading psychology

FAQs

Can you make a living off day trading?

To potentially make a living off day trading, it is important to have a solid trading strategy that incorporates analysis on reasonable returns to cover your living expenses. Keep in mind, you should have strong risk management and utilize multiple strategies that adjust for different market conditions.

Day trading can certainly be a career for many who have the discipline, tools, education, and keen understanding of their trading psychology and style. The best way to get started is with a free demo account to hone your skills and learn what products and markets best suit your day trading style.

How much do you need for day trading?

For most day traders in the US, the legal minimum balance required to day trade stocks is $25,000. This is known as the Pattern Day Trader (PDT) Rule. However, Nadex is exempt from the PDT Rule. Plus, you can open a live account for free - that's right, no minimum deposit required. Not ready for a live account? Try our free demo account.

Can you day trade more than three times a week?

Yes, you can day trade more than three times a week! A pattern day trader is a person who executes four or more trades over five business days and usually must follow the Pattern Day Trader (PDT) Rule. Nadex has no Pattern Day Trader Rule and offers thousands of contracts with durations from five minutes to a week. You can trade 23 hours a day, 5 days a week. Nadex is the home for day traders looking to capture short-term forex, stock indices, and commodity market volatility.

How do I become a day trader?

To become a day trader, you must put in the time to learn and practice trading the markets. Get started by reading a guide on day trading for beginners. Next, apply what you learned by practicing on a free demo account.

Nadex products are well-positioned for day trading. Binary options, knock-outs, and call spreads are available with various contract durations, giving you access to intraday opportunities with built-in risk. With our expert customer service team and learning center, Nadex can potentially help you reach your day trading goals at a pace that’s right for you.

Can day traders hold stocks overnight?

Day traders can hold stocks overnight, although this technically would not be considered a day trade. Nadex Binary Options and Knock-Outs have weekly contract durations on stock indices markets, so you are able to hold positions overnight. Trading hours on Nadex encompass what other exchanges call regular trading hours or the trading session — traditionally the time between the opening bell and the close — as well as after-hours trading.

Back to Blog

Back to Blog